Nicaragua Property Market Report – 2026

2026 Real real estate market update

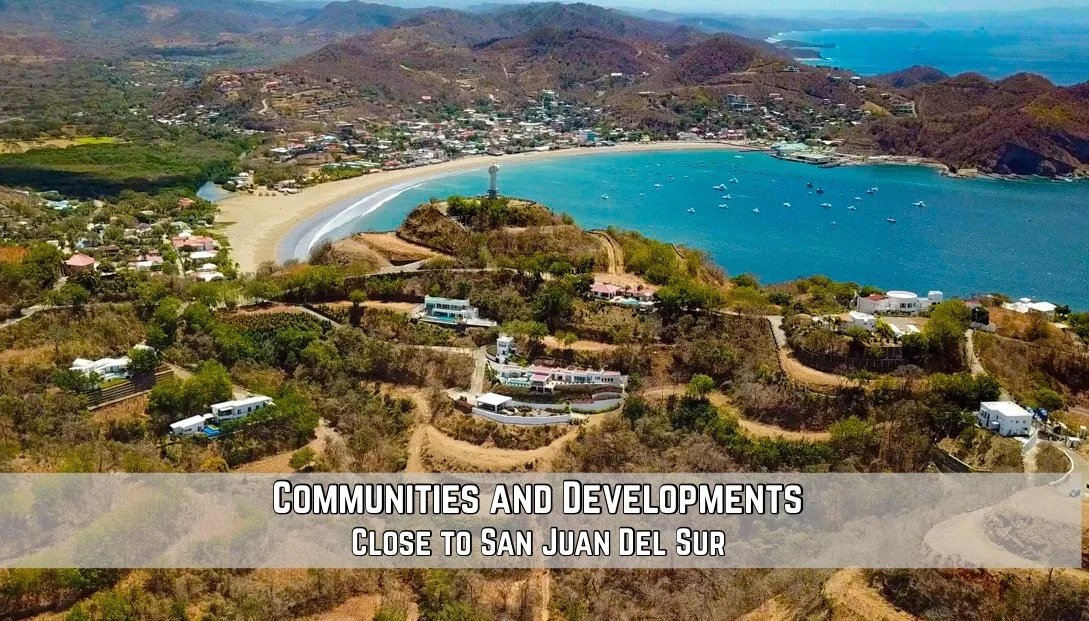

Nicaragua’s real estate market entered 2026 with continued momentum following a strong 2025. Property values appreciated steadily, sales volumes remained healthy, and buyer demand—particularly in San Juan Del Sur and the Popoyo area along the Pacific Coast—continued to grow. These trends were supported by rising tourism, stable macro-economic conditions, and the transformative $400+ million coastal highway project, which is reshaping accessibility and long-term development potential across the region.

Pacific Coast Market Activity

Real estate values and transaction volume along Nicaragua’s Pacific Coast continued to trend positively through 2025. Based on ongoing market analysis and input from brokers, attorneys, builders, and other professionals active in the market, San Juan del Sur and the Tola/Popoyo area grew.

Existing homes continued to be the most in-demand segment. Detached single-family residences—especially in gated communities that offer security, established infrastructure, and proximity to the coast—remain particularly attractive to foreign buyers. These buyers are typically seeking construction standards and build quality comparable to what they are accustomed to in their home countries.

That said, purchases of building lots and new construction starts also increased during 2025. This reflects a housing inventory that has yet to fully catch up following the pandemic-era slowdown in development. At the same time, total transaction volume has increased, and demand—especially from foreign buyers—continues to grow. The result has been upward pressure on pricing in established coastal markets.

Construction costs have also risen noticeably over the past several years. Inflation in materials and labor has pushed new-build costs higher relative to purchasing existing homes, and this continues to influence buyer decisions and pricing dynamics.

Long-Term Pricing Context

Nicaragua’s real estate market has followed a generally upward trajectory for more than fifteen years, with the main interruption occurring during the post-2008 global financial crisis. When adjusted for inflation, property values today have largely returned to levels seen during the pre-2018 boom period and the pandemic-era peak.

Even so, prices remain dramatically lower than in neighboring Costa Rica. Just across the border in Costa Rica’s Guanacaste and Nicoya Peninsula—one of the region’s premier luxury and vacation rental markets—Median listing prices for residential properties in Costa Rica’s Guanacaste and Nicoya Peninsula regions have reached approximately USD $1.32 million highlighting the exceptional value still available in Nicaragua.

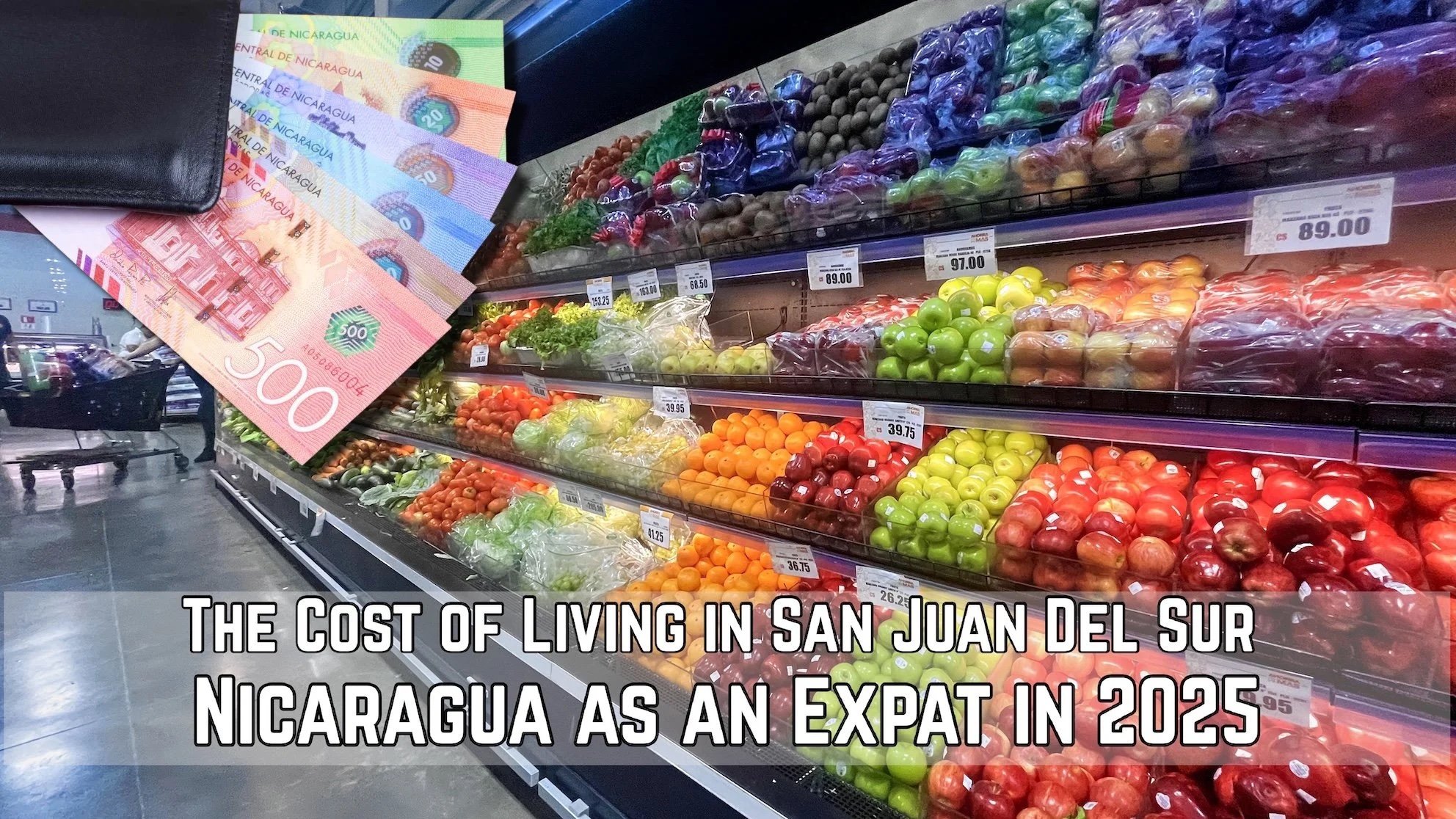

For this reason, I expect Nicaragua to continue attracting foreign buyers who are opting out of Costa Rica but still want access to a similar coastal lifestyle and climate at a significantly reduced entry point. The cost of living is also a major driver - on average it costs 50% more to live in Costa Rica.

Tourism Growth and Real Estate Demand

Tourism continued to be one of the most important drivers of economic activity and real estate demand in Nicaragua during 2025. Visitor numbers increased again, making 2025 another record year and extending the industry’s upward trajectory.

More importantly, growth was not limited to arrivals alone. Average daily spending per tourist increased by approximately 21.9%, while the average length of stay rose to 9.6 days—an increase of about 7.9%. In practical terms, visitors are staying longer and spending more while they are here.

These trends directly support real estate along the Pacific Coast. Higher visitor spending and longer stays strengthen performance in hotels, restaurants, and service-based businesses, particularly in beach destinations such as San Juan del Sur, Popoyo, and the broader Emerald Coast. Based on government tourism reports and year-end projections, total hospitality revenue in Nicaragua is estimated to have increased by approximately 10% in 2025.

Macro-Economic Context

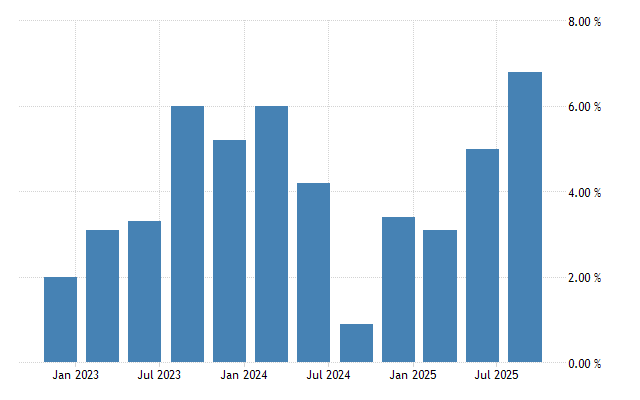

According to the Banco Central de Nicaragua, the broader economy provided a stable and supportive backdrop for real estate activity throughout 2025. Economic growth reached approximately 3.9% in the first half of the year, accelerated to 6.8% in the third quarter, and is estimated to have closed the year with real GDP growth in the range of 4.5% to 5.0%. Inflation slowed to approximately 2.7% in 2025, helping preserve purchasing power and improve overall economic stability.

Looking ahead, the Central Bank and IMF project economic growth of 3.5% in 2026. While this represents a modest moderation, the outlook remains positive and continues to support consumer confidence, investment activity, and development—especially in tourism-focused regions along the Pacific Coast.

Professionalization of the Real Estate Market

Another important development shaping the market is the implementation of Nicaragua’s new real estate brokerage law. This legislation represents a meaningful step toward a more transparent property market nationwide.

By formalizing broker and agent registration, requiring clearer documentation, and establishing government oversight, the law helps standardize how real estate transactions are conducted. These changes improve accountability, reduce ambiguity in representation, and create more consistent expectations for both buyers and sellers—particularly in high-activity coastal markets where foreign buyers and higher-value transactions benefit from clearer processes and professional standards.

Outlook for 2026 and Beyond

Looking ahead to 2026 and beyond, the outlook for Nicaragua’s Pacific Coast real estate market remains positive. Continued tourism growth, improving infrastructure, and stable economic conditions are expected to support ongoing demand for residential, vacation, and investment properties.

While construction costs and broader global economic conditions remain factors to watch, the combination of affordability, lifestyle appeal, and increasing market professionalism continues to position Nicaragua’s Pacific Coast as one of the most compelling real estate markets in Central America.

Tourism, real estate demand, and infrastructure investment are closely linked, and together they point toward the continuation of these positive trends. Nicaragua’s real estate market tends to be characterized by slow and steady appreciation rather than speculative cycles. I would estimate average appreciation in the range of 5% to 8% per year, with certain areas potentially seeing higher growth, especially where accessibility is improving.

If you’re looking for short-term speculation or highly leveraged returns, Nicaragua may not be the right fit. But for buyers seeking long-term stability, lifestyle value, and income potential in strong coastal locations, it remains a compelling opportunity. In my experience, lifestyle remains one of the most enduring reasons people choose to invest here—and that hasn’t changed.

Thanks for reading and message me any of the ways below if I can help!

Joel Stott-Jess

LifeInNica.com

Cell / WhatsApp: +505 8176 8624

US Number 1 786 651 5481

Skype: joelstottjess

Broker Number: 144-2025

Joel Stott-Jess is a New York Times featured agent / broker in San Juan Del Sur, Nicaragua.

Originally from Alberta, Canada he has been doing business in Nicaragua since 2014.